Call us now:

Best Gold IRA Companies

94 out of 5 stars, based on 361 customer reviews. You can also roll over your 401k assets into a Precious Metal IRA. Typically, precious metals Individual Retirement Accounts are most economical when their value is higher, and that is where a rollover makes a great deal of sense. 995 fine the American Gold Eagle is the only exception while Silver must be at least. The following is the list of the best precious metals IRA companies right now. Gold comes in many forms, from coins to bars and rounds, and each type has its own advantages. 9 out of 5 stars on Trustpilot, as of September 20, 2022. Another problem that New Silver is solving is the ability to find an investment property. Precious metal prices tend to act in opposition to the stock market: when equity prices are low, gold typically rides high. The inclusion of precious metals within an IRA account can potentially offer the investor additional diversification and growth opportunities. We make the IRA contribution process as seamless and efficient as possible, and have several experts on staff who can work with your custodian of choice to facilitate an account opening or transfer. And again, this is why you need a professional company to help you get the process done easily. Gold and silver have historically been one of the best hedges against inflation due to the increase in demand for precious metals when inflation is high.

Bank of Maharashtra Home Loan Schemes

For questions, call our Client Services Team at 866 928 9394. So if too much of your portfolio is in gold, you’ll be missing out on growth you could have gotten from other investments. First and most important: Check the Better Business Bureau’s profile reported Outlook India on a company before doing business with it. Gold British Lunar Series. Once your funds have cleared, your chosen custodian will purchase the metal on your behalf and store it in their secure depository. We wanted to narrow down the list to those that would answer your questions right away, either with a live chat rep, or an easy to use request form. It even includes a badge promoting this promise on its website. The IRS requires that a custodian administer and track the assets in an IRA – a Precious Metals IRA is no different. One such avenue gaining popularity is investing in Silver IRAs. But how do you go about investing in gold. Government for you or your beneficiaries. Best for retirement account rollovers.

What Assets Are Most Important To Lenders?

Account Form: IRA New Precious Metals Account or Rollover. Although physical gold isn’t highly liquid, it has a high tendency to preserve its value over the long haul. What Does It Cost To Start An IRA In Precious Metals. While the custodian or trustee oversees the accounting, the SEC dictates that they are not responsible for the gold seller or broker that the investor uses. Once the funds are transferred to your Precious Metals IRA, we’ll then provide you with resources to select the precious metals. It also charges no lender fees at closing, making it an affordable option. The news and editorial staff of the Delco Daily Times had no role in this post’s preparation. These days, however, Gold IRAs are enjoying newfound popularity and are more viable than ever. The best way to pick the most convenient custodian is to pay attention to their qualifications.

1 888 812 9892

Our Coin Advisors specialize in constructing balanced and diversified hard asset portfolios with a strict focus on safety, security, and privacy. The company also allows clients to buy gold and silver coins and bars even if they don’t have an IRA, which is a convenient alternative if customers want to purchase precious metals due to other reasons. With some stocks and bonds in your IRA, you ensure that your savings are not only valued but also earning you money. The IRS requires that you keep your IRA Precious Metals in a custodian account. In January 2022, launching support for stock and ETF trading. There is no assurance that the spending power of a particularly strong currency like the US Dollar might remain in such a position within the coming months. They also offer a wide selection of gold and silver coins and bars, as well as a variety of precious metals backed IRA accounts. A central aspect of any investment strategy is diversification. In Goldco’s Investor Kit, you’ll learn. Best of all, Birch waives the fees for all accounts over $50,000. Staking involves considerable risk. Noble Gold offers free shipping and competitive pricing on gold and other precious metals. Silver and Gold can be purchased in round, bar or coin form as well as in bullion form. The depositary’s purchase is the second option.

Software and Business

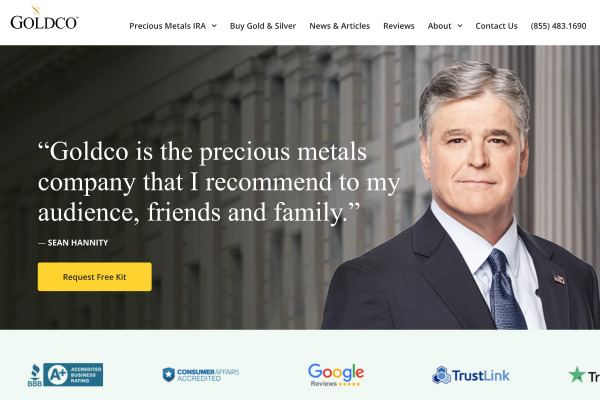

They have solid communication and are available throughout to answer questions. Clients who already have a Traditional, Roth, SEP, or Simple IRA might consider a Silver IRA rollover. Unlock the Benefits of Patriot Gold Club Today and Enjoy Unparalleled Financial Security. A transfer can be direct, meaning it is sent directly from one custodian to another or indirect meaning that the funds are sent from a custodian to the account holder. Invest in RC Bullion and Reap the Benefits. A gold IRA functions in a manner similar to a traditional IRA. This customer focused approach to serving investors has earned Goldco Precious Metals near perfect reviews on trusted platforms such as Trust Pilot and Consumer Affairs. Because of these rules, it’s important to find a reputable company to work with. Next, you will need to transfer the funds from your traditional IRA or Roth IRA into the gold IRA. 2021 marked the end of an era as the last issue to feature the classic design used since 1986. The company specializes in silver and gold coins and bars for your IRA. Their commitment to providing quality service and their dedication to helping customers make the best decisions when it comes to investing in silver IRAs is unparalleled.

4 Lear Capital: Best for Experience

Date of experience: June 28, 2021. Fine content is measured in Troy ounces. 5% and also possess a refiner/assayer hallmark stating it has been approved by NYMEX or COMEX. Experience Exceptional Customer Service with American Hartford Gold. APMEX recommends discussing the details of your personal investment strategy with your IRA Custodian or financial adviser. As you work your way towards retirement, continue to add to your IRA each year to grow your wealth. Reply STOP to opt out from text messages.

‘Celebrating Ambadas’: On His 100th Birth Anniversary, An

Pricing and market conditions were explained in detail and left us hanging up with no unanswered questions. Oxford Gold is a top rated gold IRA company. Because gold bullion bars sell at smaller premiums than gold coins, they are ideal for IRAs. When selecting a gold IRA provider, it’s important to look at several factors such as pricing structure and fees associated with investing in precious metals through them. Remember that you should understand and adhere the custodian’s guidelines on withdrawal too. There’s nothing stopping you from restricting the amount of gold and silver you keep in your IRA. The standard thing people do is make a gold IRA rollover, which is using the funds from existing retirement savings to fund a silver IRA. No option to buy precious metals such as platinum or palladium. For the best overall Gold IRA company go with Augusta Precious Metals if you have $50,000 or more to invest. Our expertise is also recognised by international media, with GoldCore executives appearing as Precious Metal Experts on radio and television, including CNBC, CNN, Reuters, BBC, and Bloomberg TV. In American Hartford Gold’s Investor Kit, you’ll learn. Let’s see which is the best gold investment company in the market. 25 oz to 2 oz of Silver. Please consult your trusted tax adviser before making any decisions.

Patriot Gold Club: Summary Silver IRA

However, it’s important to remember that the amount of silver you can purchase is limited by the amount of funds in your account. It is one of the company’s most valuable services, as they allow investors to understand how gold investments can affect their portfolio. Our approach allows investors to safely and securely purchase metals within IRS guidelines. If you’re eager to set up an IRA gold investment, we’ve listed some of the best gold IRA platforms, as well as the gold IRA pros and cons for each company. Begin your journey to secure future financial stability with this powerful asset. With their gold and silver IRA accounts, customers can diversify their portfolios and prepare for retirement. We already mentioned that aside from gold and silver, platinum and palladium are also eligible for investment under a Gold IRA model. Experience the Precious Difference with Augusta Precious Metals: Invest in Quality and Security Today. What would be the reason why you would rather go through the hassle of setting up a precious metal IRA. The custodian will help you create a new IRA or transfer funds from an existing IRA, and then you can use those funds to purchase physical gold and precious metals. GoldCo: A Reliable Choice for Your Precious Metals IRA Needs. With Madison Trust’s Self Directed Gold IRA, you can invest in several types of metals, including gold, silver, platinum, and palladium.

American Hartford Gold: Best for New Investors

The rules for a traditional IRA applied to this one as well. Unlike some businesses, Augusta takes the time to build trust with customers. According to recent research, the top gold and silver IRA companies offer their clients competitive pricing, excellent customer support, and reliable information. The IRS doesn’t have minimum investments, but it does have annual maximums. Invest in Your Future with Birch Gold Group Discover the Benefits of Precious Metals Today. They’ll create a draw schedule with you for the required repairs. If the customer can put down 20 percent to 25 percent of the cost, the company will finance the rest of this “once in a lifetime opportunity. The “proof” may be meaningless in 20 years, after an economic collapse, etc. Gold IRAs provide a hedge against inflation in times of market volatility. Orion Metal ExchangeOrion Metal Exchange claims to offer “more metal for your money and more money for your metal. This should ensure that any transaction can be done with American Hartford Gold regardless of wherever the client is and at what time they made the call.

Nerve Savior Reviews Is It Legit? Uncovering The Truth

CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. The company largely depends on crowdsourcing for its successful management since it values its clients’ feedback. Founded in 2011, Liberty Gold and Silver is a precious metals provider that offers a wide range of bullion products. You can also roll over your 401k assets into a Precious Metal IRA. The maximum APR you could be offered is 29. Disclaimer: This is sponsored content. We’re here for you throughout every step of your vehicle loan journey. Join A 100% Free Educational Gold IRA Web Conference This Webinar May Change the Way you Retire. As the US hits a new 40 year inflation high, hedging against inflation has become even more important and we can expect greater popularity of gold IRAs in the future. His experience with various investment types and their unique processes makes him an invaluable asset. Subscribe to the Texas Bullion Newsletter to receive notification of our special offers, numismatic news, and announcements of new products. A gold IRA rollover guide is an important resource for individuals who are looking to diversify their retirement portfolios. Fast transaction processing.

4 Use an Approved Depository

You’re free to ask questions and speak to the representative about what type of precious metals will suit your investment goals and risk tolerance, helping you make an informed decision about your portfolio, but the company does stress the need to speak to a professional financial advisor before investing in a gold IRA. Great option for my flip. As retirement draws near, it is quite normal to wonder what exactly you can do with all of that money you have saved. Even with the 1% commission in and out if they had bought bullion coins originally, like the American Eagle coins, they still lost big by buying the proof coins. Opening a precious metals IRA is easy and safe as long as you follow the simple steps outlined below. It’s more like SUPER SUPER EXCELLENCE SERVICE from NEW SILVER. He made the process very easy. Silver Eagle, Canadian Silver Maple Leaf, and the Mexican Silver Libertad bullion coins. Goldco also handles the purchase and storage, but you will pay additional fees depending on your depository requirements. Noble Gold’s knowledgeable and experienced team of financial advisors are always available to answer any questions and provide guidance to ensure customers have a safe and secure gold IRA investment experience.

Q: Are collectible coins eligible for Precious Metal IRAs?

Furthermore, individuals can make good use of the tax advantages cited in the previous section to build a diverse portfolio, aiming for financial stability and the actual ability to rest in their retirement years. Silver, Platinum and Palladium. 5 Stars based on a number of factors, including: Team, Pricing, Support, Security, and Selection. Quick, user friendly experience. Note: the company does have a minimum investment amount of $25,000. The last benefit people get when investing in gold and silver IRAs is that they can diversify their portfolios. Birch Gold Group also offers a free investor kit. The company also offers a variety of retirement plans such as traditional, Roth, and SEP.

What is Gold IRA

Noble Gold offers free shipping and competitive pricing on gold and other precious metals. Like all IRA products, a Gold IRA offers tax benefits to investors. Their knowledgeable and responsive customer support team can guide you through the process, helping you make the best decisions for your retirement. Discover Quality Precious Metals at Augusta Precious Metals Buy Now and Enjoy Exceptional Value. This gives you more security knowing that you’re not stuck with your gold if it no longer matches your goals. Their high quality coins already eligible for your gold IRAs, and includes. A company’s reputation says a lot about the experience it can provide you. Our goal at Reagan Gold Group is to exceed our clients’ expectations with diversification and assure the preservation and protection of your current assets. If you cannot meet their account minimum, you’re still in good hands with any of the gold IRA companies on our list. 99% pure, what the industry calls “four 9s gold. We may be compensated from the links in this post, if you use products or services based on our expert recommendations. Brokers are not anxious to promote true diversification away from these paper assets, as they would lose out on management and/or transaction fees. Overall, when searching for a Gold IRA lender, it’s important to do your research and choose a reputable and legitimate lender to ensure a positive and successful loan experience.

CONTACT INFO

Even if you need a large quantity of physical precious metals, Augusta can help you. >>>>Click here for Free Gold IRA Kit<<<<. Join our mailing list to receive updates. IRA approved silver holdings are a self directed investment that is controlled by you, the investor. When choosing a depository for your metals, you'll need to choose what type of storage you want: allocated or unallocated. This means that if you need cash for something unexpected, you don't have to wait until retirement age before cashing out your account. Gold and silver represent the most popular choices, though you'll find platinum and palladium as well. Therefore, this article is meant to guide you on how to manage the transfer of gold IRAs and the different methods you have to achieve this. They will take care of the paperwork and use their insight to help you select storage and custodial services that the IRS approves. FREE Gold IRA Investment Kit. Legitimate Gold IRA lenders are those that are regulated by the appropriate authorities and have a long standing reputation in the industry. Gold American Buffalo 99.

BUY PRECIOUS METALS

We may earn money from companies reviewed. The company makes the process of opening a gold IRA appear very simple. 6972 allows storage at TPM Depository. Its popularity stems partly from the fact that the licensed gold IRA custodian has waived all fees for the first year. Once the account is set up, you’ll need to initiate a rollover of funds from your existing retirement account into the new Gold IRA account. With this strategy, when you distribute your assets you will receive the same type of bullion you put into storage but they may not be necessarily the exact metals you purchased. This includes tips for preparing for a recession and a guide for opening a gold IRA. Withdrawals from a SEP gold IRA are taxed at the investor’s marginal tax rate. When researching gold IRA companies, look for ones that are reputable and have a good track record. Alternatively, you can let American Hartford Gold choose for you. Before anything else, you have to remember that the availability of certain gold and silver coins and bars do change from time to time. With a commitment to providing top notch customer service and a team of experts with decades of experience, Birch Gold Group is a reliable and trustworthy choice. » Read Birch Gold Review. Understanding your options is crucial before making any final decision and should not be a process that is taken lightly.

All that Glitters Might Be Gold, Silver, Platinum, or Palladium

It’s also important to consider the fees associated with working with a Gold IRA custodian. Here’s good news: you can easily rollover an existing IRA to an IRA backed with gold and silver. Additionally, the company offers a range of tools and resources to help customers make the most of their investments. Free gold when you purchase a gold IRA, top scores with the BBB and BCA. This can be done by streamlining the process and providing a bit of leeway for the maintenance costs. NMLS ID: 35286 ; California DFPI Residential Mortgage Lending Act License No. Contact your IRA Custodian or Administrator to ask them how.

RECOMMENDATIONS

Lear Capital, Noble Gold, Patriot Gold Club, Gold Alliance, Advantage Gold, Birch Gold Group, RC Bullion, GoldBroker and Augusta Precious Metals are all great options for investors looking to diversify their portfolios with gold and silver. The self directed IRA gives you the power to decide exactly what type of precious metals you invest in. Silver IRAs are a great way to diversify your retirement savings and add a precious metal to your portfolio. Sometimes, people will even get one on one assistance from knowledgeable experts. Note: Bullion is not legal tender. The Better Business Bureau and Trustpilot are good resources to find ratings and reviews of companies.

100% of our website is encrypted and we never share your info!

You acknowledge and understand some experts in typical times recommend a diversified investor’s portfolio contain a rare coin and precious metals component of 5% minimum to a maximum of 25%. In fact, there are many popular silver bullion products that are not eligible for IRA investing solely because they’re unable to meet the purity requirements set forth by the IRS. Some factors to consider when selecting a silver IRA company include fees, reputation, customer service, and investment options. Check For Augusta Promotions →. A gold and silver IRA is a type of retirement account that allows investors to hold precious metals such as gold and silver. Advertising Disclosure. Exploring the Benefits of Investing with Advantage Gold: A Must Try for Smart Investors. However, you have the option of choosing any custodian and storage custodian of your choice.

Jodi White Joins the First Home Team as Branch Manager of Our New Gainesville, VA Office

GoldBroker is the top choice for those looking for the best gold IRA companies. It currently uses Brink’s Global Service. The IRS defines many popular coins as collectibles, and therefore, not permissible in IRAs. The pandemic has also brought about job losses and changes in the way people think about employment in general. Canadian Palladium Maple Leafs. Once you have opened a custodian account, you can fund a new account, as well as transfer or rollover an existing IRA or former employer 401k. Today, the name is used to describe firms that accumulate an inventory of precious metals and sell it to coin dealers, jewelers, or investment companies. In addition, investors should look for companies that have excellent customer service and offer a range of investment options. Read about the various things that can affect the price of gold.